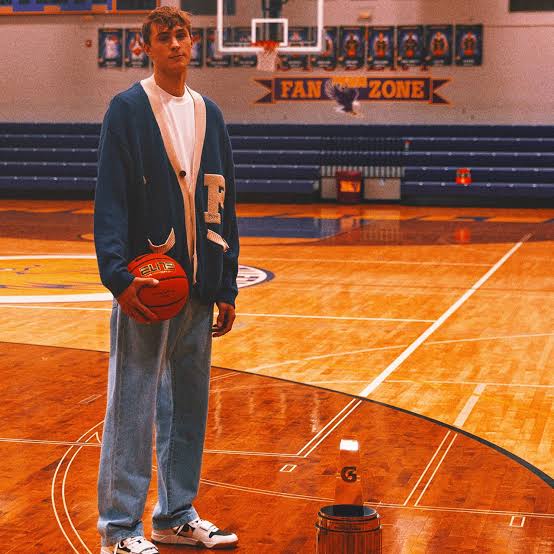

In a landmark year for both college basketball and the evolving landscape of Name, Image, and Likeness (NIL) compensation, Cooper Flagg, the phenom from Newport, Maine, etched his name into the financial record books by securing an unprecedented $28 million in NIL deals during his lone season at Duke University. That figure doesn’t just make Flagg the highest-earning NCAA athlete of all time—it redefines what’s possible for a collegiate player in the NIL era.

Flagg entered college basketball with considerable hype, having been crowned the No. 1 player in the 2024 recruiting class. At 6-foot-9 with elite two-way skills, freakish athleticism, and a competitive fire that mirrored NBA stars, Flagg was viewed not only as a future top NBA draft pick but also as a marketable figure with crossover appeal. His blend of small-town roots, charisma, and on-court dominance made him a natural NIL magnet even before he stepped on the hardwood at Cameron Indoor Stadium.

The structure of Flagg’s NIL earnings was not built on a single megadeal but rather a strategic combination of national endorsements, digital content licensing, apparel partnerships, and equity-based agreements. His representation, led by one of the most influential sports marketing firms in the country, took a deliberate approach—treating Flagg less like a typical college athlete and more like a young professional brand.

Major brands flocked to Flagg early. Nike, which has long had deep ties to Duke and has historically targeted generational basketball talent, signed Flagg to a multi-million dollar NIL partnership reportedly worth over $8 million. The deal included signature apparel drops, exclusive campus activations, and a presence in global marketing campaigns. Flagg’s blend of on-court flair and relatability made him the ideal face of Nike’s push to appeal to Gen Z consumers.

But Nike wasn’t the only corporate giant to get in line. Gatorade offered a performance-focused endorsement deal that reportedly netted Flagg another $4 million. The beverage company used Flagg in national television and social media campaigns, including a viral behind-the-scenes training series that became a staple on YouTube and TikTok. Flagg’s authenticity in front of the camera and genuine approach to storytelling helped these ads resonate beyond typical sports audiences.

Flagg also dipped into tech and media. A content production agreement with a major digital platform allowed Flagg to monetize behind-the-scenes footage from his life at Duke, including training sessions, game-day rituals, and community appearances. This deal alone brought in an estimated $3.5 million. His YouTube channel and affiliated platforms grew to millions of followers, and the ad revenue and sponsorships associated with those channels proved remarkably lucrative.

What truly set Flagg apart from his peers, however, was his willingness to engage in equity-based partnerships. He turned down several high-paying, short-term endorsement opportunities in favor of long-term ownership stakes in startups focused on fitness technology, sportswear, and nutrition. One notable deal involved a rising athletic wear brand that granted Flagg equity in exchange for promotional appearances and product development input. Industry insiders valued his share of that company at $5 million by the end of the college season—up from an initial $2 million valuation at the time of the agreement.

Even beyond the traditional commercial landscape, Flagg capitalized on community-driven initiatives. He partnered with local North Carolina businesses and non-profits to create limited-edition merchandise drops, with portions of proceeds going to youth development programs. These deals were smaller in scale but carried enormous PR value, further enhancing Flagg’s reputation as not just a basketball prodigy, but a thoughtful, grounded young leader.

By the time March Madness rolled around, Flagg had become a national sensation—not just for his spectacular dunks and clutch performances, but for the empire he had quietly built off the court. As Duke made a deep tournament run, culminating in a Final Four appearance, Flagg’s NIL valuation surged. Post-tournament bonuses tied to performance metrics and viewership engagement added another $3 million to his portfolio.

Of course, none of this would have been possible without the NCAA’s landmark NIL ruling, which allowed athletes to profit from their personal brand while maintaining eligibility. Flagg’s case, however, may be the most significant demonstration yet of how far that rule change has shifted the economic landscape of college sports. No longer is college basketball merely a stepping stone to the NBA—it can now serve as a fully monetized platform in its own right.

Flagg’s financial success has already begun to shape the recruiting strategies of top programs and the career paths of future stars. High school athletes and their families are taking notice of the precedent he has set—not just in terms of earnings, but in the savvy way his team managed his image and capitalized on cultural relevance. Universities are now investing more in NIL infrastructure, hiring branding consultants, legal teams, and financial advisors to support their athletes.

As Cooper Flagg prepares for the NBA Draft, where he is widely projected to be the No. 1 overall pick, his Duke experience will be remembered not only for the highlight-reel blocks and step-back threes but for breaking the ceiling on what a college athlete can earn and represent. He leaves Durham not just as a college basketball star, but as a case study in 21st-century athletic entrepreneurship.

Flagg’s $28 million season stands as a watershed moment—proof that in the NIL era, the value of a player goes far beyond points and rebounds. It extends into branding, storytelling, community, and the ability to shape culture at the intersection of sports and business.